Limited to the First 50 People:「Gurutore」EA Free Giveaway!

✔ Predict whether to buy or sellUSD/JPY +213,607 in 2 days, etc

✔ Profit in the expected direction or range

✔ Profit even if the forecast is wrong, as long as it returns to a certain level

✔ Detailed settings for order interval, profit/loss, etc

✔ Automated trading from a few hundred dollars

✔ Easy to exit by clicking the “Close All” button.

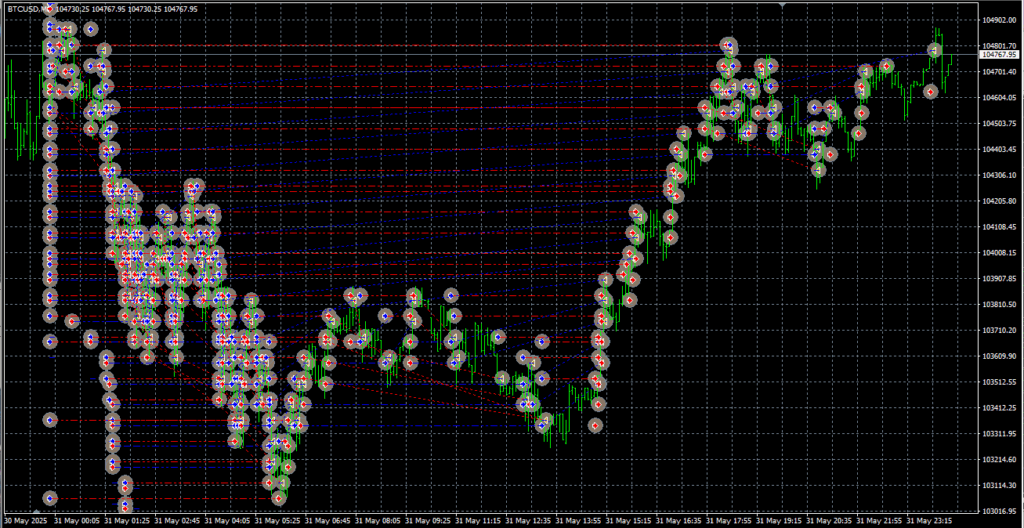

✔ Available for FX, commodities and cryptocurrencies

✔ Can be tested with a demo account

It comes with an introduction and setup manual, etc., so that even MT4 beginners can use it for automated forex trading.

After distribution, we also provide support on line and by e-mail, so please feel free to contact us.

⇒ We also support you in the messenger

How GurutoreEA works

Gurutore is a collection of IFD and limit orders

First, let us explain how Gurutore works.

Gurutore is an aggregation of IFD (ifdan) orders and limit orders, and is a method of making profits by placing many orders and adding support as well as building up execution cycles.

The name “Gurutore” was born from the image that comes to mind when one hears the Japanese word “Guru-GuruTrain,” which is like an order looping.

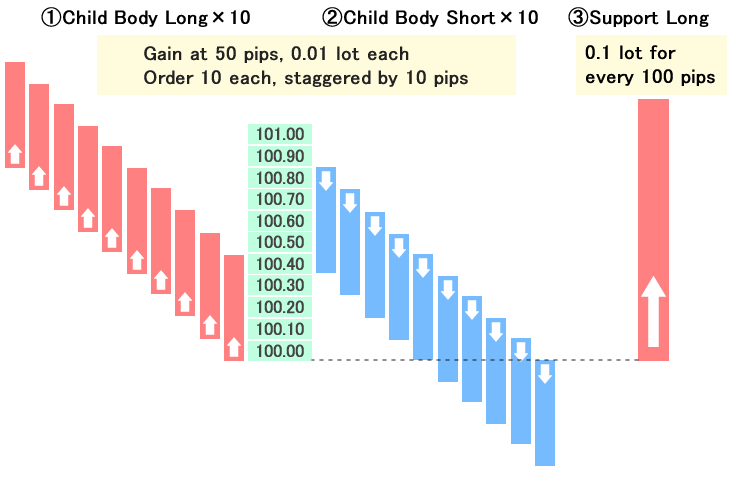

For example, in the case of the U.S. dollar, the basic model consists of 20 IFD orders (child) and 1 limit order (support) per 100pips, and there are two patterns: long and short.

In Gurutore, IFD orders are called “child” and limit orders are called “support”. If the support is long, the order is called “Gurutore Long,” and if the support is short, the order is called “Gurutore Short”.

Specifically, the system is designed to predict whether rates will rise or fall, and if the predictions are correct, profits will naturally be earned.

①Child Body Long = Long IFD order for 50 pips gain. (0.01 lot)

②Child Body Short = Short IFD order for 50 pips gain. (0.01 lot)

The child long and short orders will be staggered by 10 pips, 10 each for every 100pips.

③Support Long = Limit order. (0.1 lot)

Support longs will not be settled until the gurutore is closed.

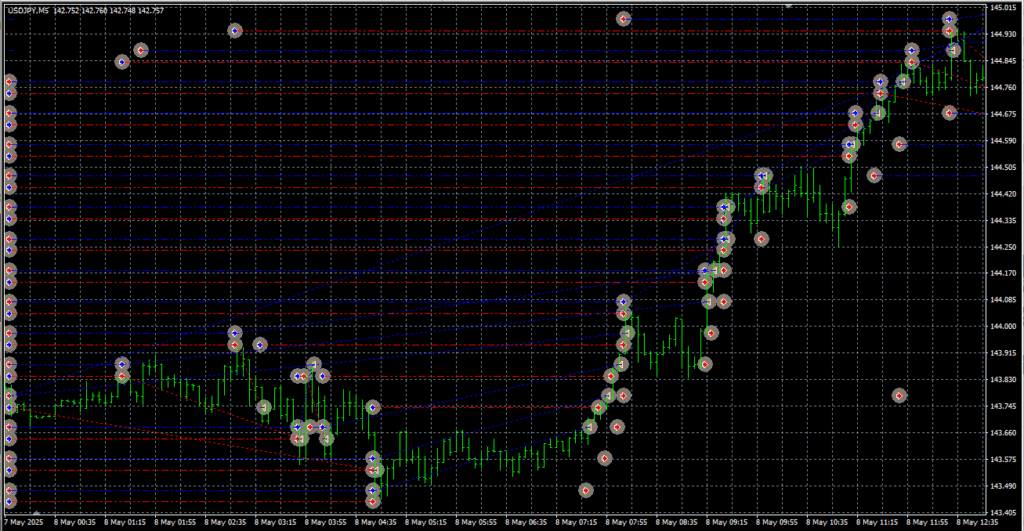

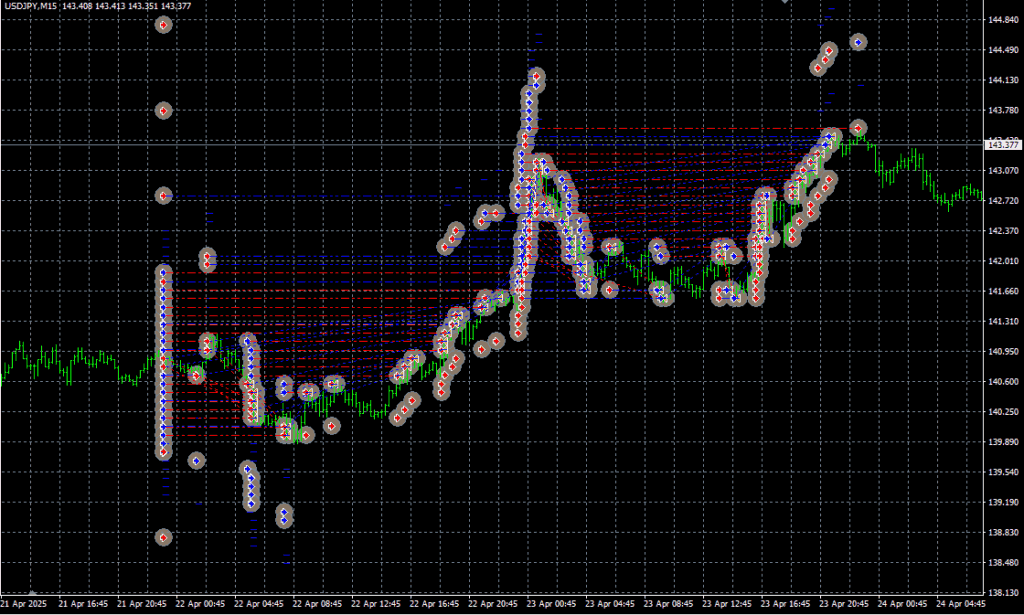

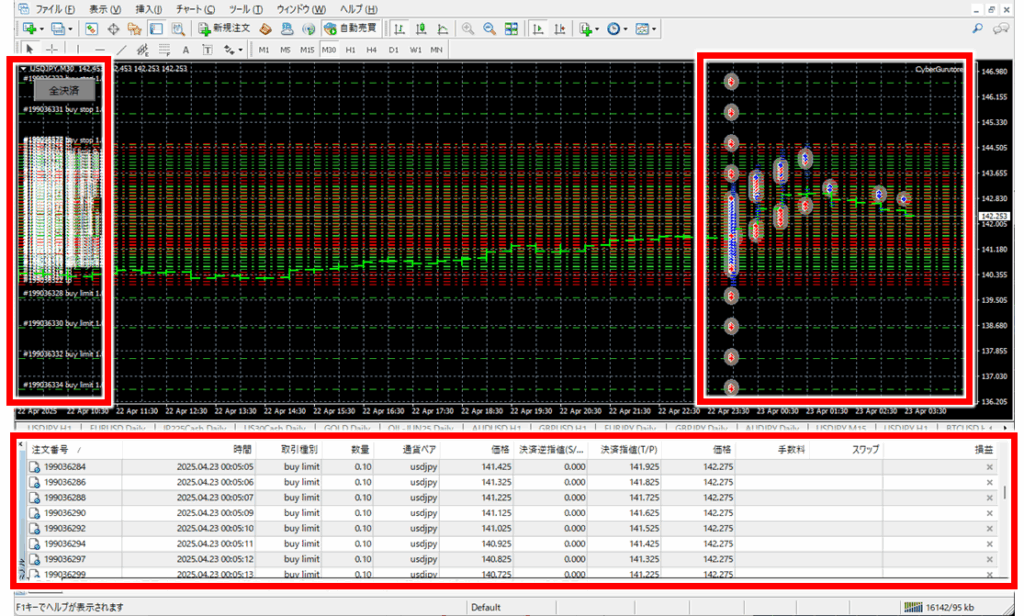

[Short Video] CyberGurutore operating conditions

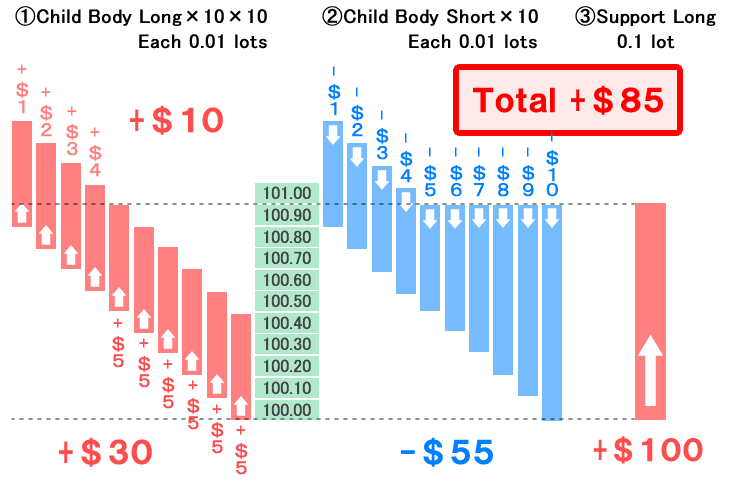

If 100pips rise in Gurutore

+$85 profit

Total:①+$40 ②-$55 ③+$100=+$85

①Child Body Long +$40

$5 profit confirmed x 6 pieces=+$30

Profit of $4, $3, $2, $1=+$10

②Child body short -$55

-$1、-$2、-$3、-$4、-$5、-$6、-$7、-$8、-$9、-$10=-$55

③Support long +$100

This indicates that 100 pips increase in Gurutore longs would result in a profit of +$85.

If the trading volume of the child body is increased from 0.01 to 0.1 and the support long from 0.1 to 1.0, the profit would be $850, which is the initial value of the Cybergurutore.Thus, when changing the position volume, increase or decrease the child body and support order volume by the same percentage amount.

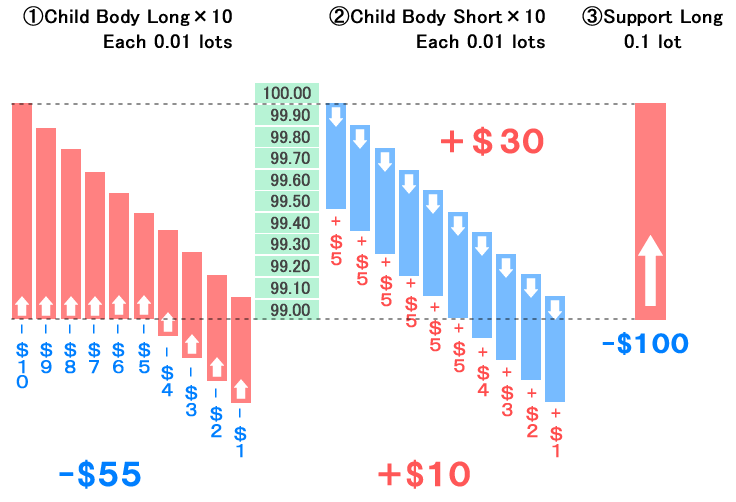

If the Gurutore fall by 100 pips

-$115 loss, but we can recover.

①Child Body Long -$55

-$10、-$9、-$8、-$7、-$6、-$5、-$4、-$3、-$2、-$1=-$55

②Child body short +$40

Profit of $5 fixed x 6=+$30

Profit of $4, $3, $2, and $1=+$10

③Support long -$100

Thus, a 100pips drop in the Gurutore long position results in a loss of -$115. However, the effect of Gurutore will start to emerge from this point on.

Next, let’s look at the case where the glutre fell by 100pips and then returned +50 pips.

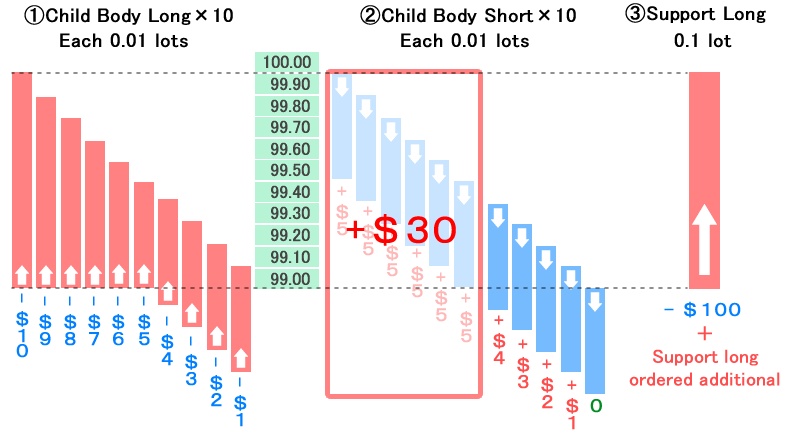

If the Gurutore fall -100 pips and then return +50 pips

Profit of +$30 is fixed when the price drops by 100pips.

First, if the price falls 100 pips, 6 child shorts with a $5 profit margin are settled, resulting in a +$30 profit. The others remain unsettled.

Then, when the price drops by 100 pips, an additional support long for 100 pips lower is executed.

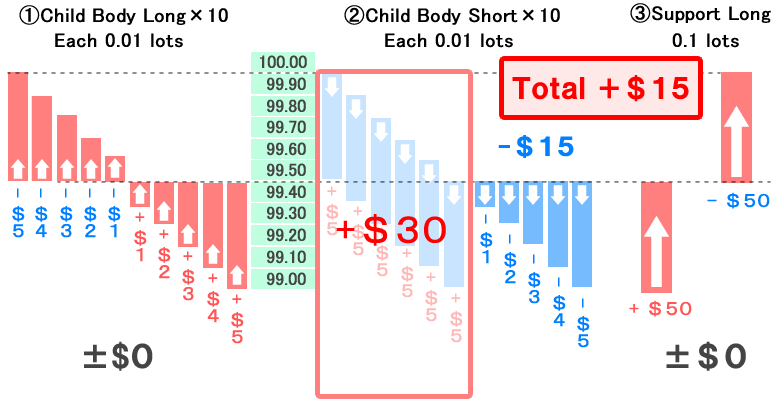

+50 pips back to +$15!

Then, when it rises +50 pips,

Total:①±$0 +$15 ③$±0=+$15

①Child Body Long ①±$0

-$5、-$4、-$3、-$2、-$1=-$15

+$1、+$2、+$3、+$4、+$5=+$15

②Child body short +$15

$5 profit confirmed x 6 pieces=+$30(The amount of interest already gained)

-$1、-$2、-$3、-$4、-$5=-$15

③Support long ±$0

-$50、+$50

Even if +$30 profit has already been made and there is a -$15 due to (1), (2), and (3) above, a +$15 profit remains.

A Gurutore-Long profit of +$15 is generated for a 50pips rise after a 100pips fall, i.e., a profit of +$15 is generated despite a 50 pips fall from the starting point.

Usually assumed to make waves up and down

Although we have simplified and explained the price movements here for ease of understanding, actual market prices are not one-way like this, but generally form while making waves up and down.

In such movements, it is safer to keep the profit-taking price range smaller than the Guru Train specifications because a wide profit-taking price range will cause the timing of profit-taking to be missed.

For example, if we assume a move of 50 pips up, 40 pips down, and the ups and downs are repeated, we can set the profit margin to 20 pips to eliminate the loss.

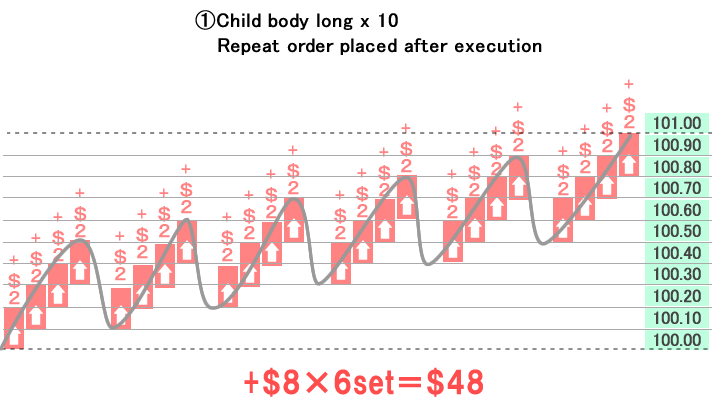

In this case, since the child order repeats after each small execution, +$8 is taken for 6 sets, resulting in a profit of +$48.

In such a move, it is normal for the price to rise about half a price and then falter, and then rise again while adjusting, so not only 6 sets of +$8 can be taken, but often many more can be taken.

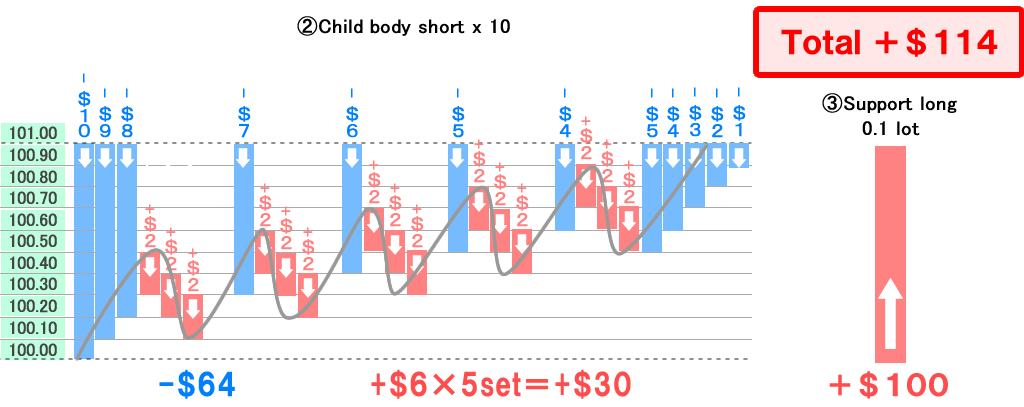

On the other hand, the child order, the short one, is somewhat less negative because it is being taken off three positions at a time in the process of dropping 40 pips.

-$10, -$9, -$8, -$7, -$6, -$5, -$4, -$5, -$4, -$3, -$2, -$1 for a total loss of -$64, plus +$6 x 5 sets = +$30, so the negative short position is reduced to -$64 + $30 for -$34.

In this section, we assumed an upward trend, but if the market were to enter a range, the sub-orders would loop infinitely, resulting in profits being added up.

And since the support long is up by 100 pips for a +$100 profit, the total profit is $100+$48-$34 = +$114, which is more profitable than the typical glue train method.

For this reason, Cybergurutore has a parameter profit margin of 20 pips. If you want to use the general guru train parameters, please refer to CyberGuruTrain’s parameters.

Total:①+$48 ②-$34 ③+$100=+$114

①Child Body Long +$48

+$8×6set=+$48

②Child Body Short -$34

-$10、-$9、-$8、-$7、-$6、-$5、-$4、-$5、-$4、-$3、-$2、-$1=-$64

+$6×5set=+$30

③Support Long +$100

[Video] How CyberGurutore works and how to earn money

Advantages and disadvantages of Gurutore

Advantage: In effect, it can handle more than 70% of the market.

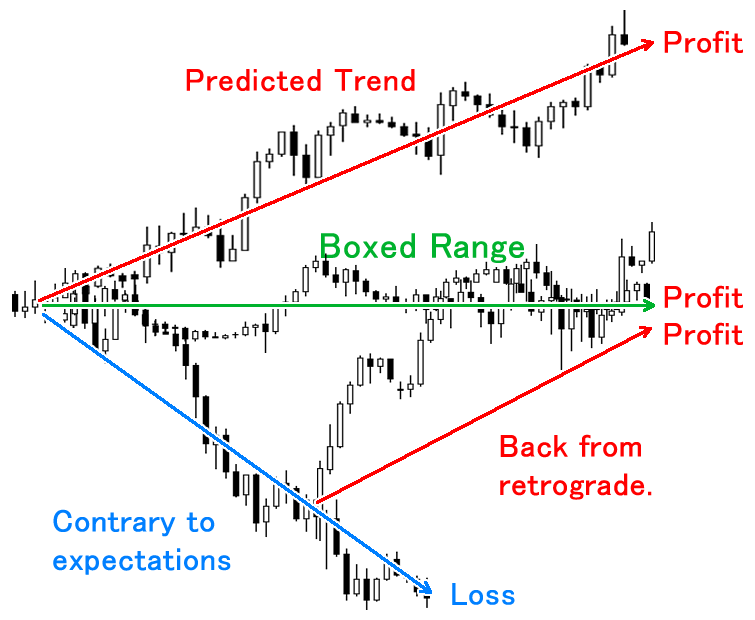

In a normal discretionary forex trade, you should be in a loss situation because you have not returned to the starting rate.

However, with Gurutore, profits will increase as it moves up and down, and if it returns to some extent, it will be profitable even if it does not return to its starting point.

Of course, if it goes in the expected direction, you can rest assured that your support position will generate profits.

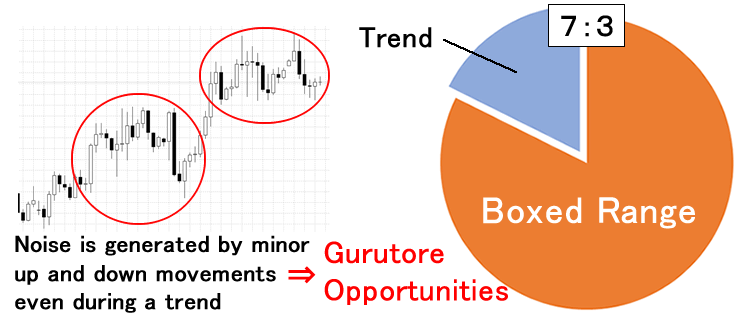

In addition, 70% of the market is said to be range-bound, and even the remaining 30% of the market trend is based on repeated minor ups and downs, which opens up even more opportunities for Gurutore.

Disadvantages: Vulnerable to one-way market movements

Although Gurutore can handle more than 70% of the market in real terms, it does have a weak point. This is when the market is one-sided and the forecast of upsides or downsides is wrong.

As we have seen, due to the nature of Gurutore, even if the forecast is wrong, the loss will gradually decrease after a while and gradually turn into a positive figure.

However, when there is an event that moves the market one-sidedly, such as a change in policy rates or a change in government, the child orders that are the advantage of Gurutore will not execute well, and the loss for support orders will increase.

In such cases, it would be safer to exit Gurutore and wait until the market calms down.

The detailed settings will vary depending on the currency pair you are using, so please try using the default settings for USD/JPY first, and then use them for various trades such as cross-yen, gold, and virtual currencies.

Pattern of profit or loss (in the case of Gurutore-Long)

- Aggregation of IFD and limit orders

- Consists of multiple orders in the child body + support orders

- Numerous IFD orders steady profit

- Limit orders aim for a price range

- Profit in the expected direction

- Strong in a range market

- Recovers with a slight reversal even if it deviates from the forecast

- Weak in one-sided markets

CyberGurutore Parameters

Highly Customizable Gurutore EA

CyberGurutore is initially set up for USD/JPY, so it can be operated as is.

However, it is necessary to set the lower and upper range limits of the installation range and change the direction of support order placement depending on the situation.

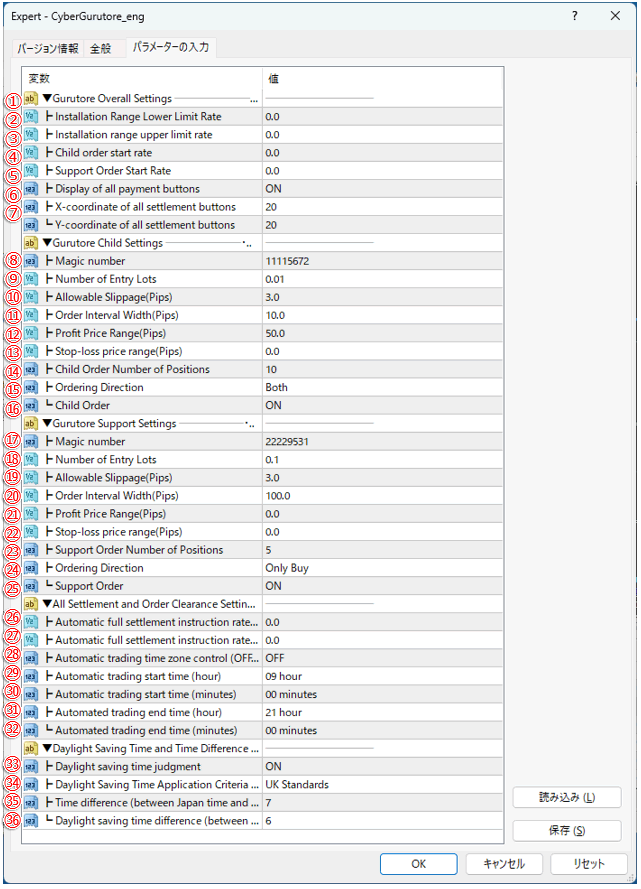

The parameters of CyberGurutore are as follows.

— Gurutore Overall Settings —-.

(1) Lower limit of the installation range rate: The system will not operate below this rate.

(2) Upper limit rate (0 means ignore): The rate above this rate will not be used.

(3) Sub-order start rate (0 means start immediately): Rate at which sub-orders are placed.

(4) Support order start rate (0 means start immediately): Rate at which support orders are placed.

(5) All Close button display: All Close button ON/OFF.

(6) All Settlement Button X-coordinate: Horizontal position of the All Settlement Button.

(7) All Settlement Button Y-coordinate: Vertical position of the All Settlement Button.

— Gurutore Child Setup —.

(8) Magic number: The number to be set individually for each EA.

(9)Entry lot number: Number of order lots for child orders.

(10)Allowable Slippage: Slippage to be allowed.

(11) Interval between orders: Interval between child orders.

(12)Gain Margin: The gain margin of the sub-order.

(13)Stop-loss range: The stop-loss range of the sub-order.

(14)Number of positions for suborders: If set to 10, for example, a total of 20 orders will be placed, 10 for buy and 10 for sell.

(15) Direction of order: Can be set to both buy and sell, buy only, or sell only.

(16)Child orders: Child orders can be turned on or off.

— Glutre Support Settings —.

(17)Magic Number: The number to be set individually for each EA.

(18)Entry lot number: The number of order lots for support orders.

(19)Allowable slippage: Slippage to be allowed.

(20) Inter-order interval: Interval between support orders.

(21) Stop-loss range: The stop-loss range of the support order.

(22) Stop-loss price range: Stop-loss price range for support orders

(23)Number of Support Order Positions: If set to 5, for example, a total of 10 orders will be placed (5 buy and 5 sell orders).

(24)Order Direction: Can be set to both buy and sell, buy only, or sell only.

(25)Support Order: Support orders can be turned on or off.

— Setup all settlement and order deletion —

(26)Automatic All Settlement Indication Rate (for profit): This is the automatic all settlement indication rate for profit.

(27)Automatic full settlement instruction rate (for stop-loss): Automatic full settlement instruction rate for stop-loss.

(28)Automatic trading time zone control (OFF means 24-hour operation): Turn ON if you want to terminate by the hour.

(29)Autotrading start time (hour): Time to start auto-trading.

(30)Automatic trading start time (minutes): minutes to start automatic trading.

(31)Autotrading end time (hour): Time to end auto-trading.

(32)Autotrading end time (minutes): Minutes to end auto-trading.

— Daylight Saving Time and Time Difference Setting —

(33)Daylight Saving Time Judgment ON/OFF: ON means Daylight Saving Time is applied.

(34)Summer time operation standard (account company): UK standard and US standard can be set.

XM will be “UK Standard”.

(35)Time difference (between Japan time and MT4 server time in winter time): XM will be “7”.

(36)Summer time difference (time difference between Japan time and MT4 server time): XM will be “6”.

Easy to use tips

There are many parameters, but if you want to use them quickly, there are only two places to set parameters. (1) Set the lower and (2)upper rate limits in the overall Gurutore settings, and (24) select buy or sell in the order direction in the support settings. If the currency pair you are using is the USD/JPY, you only need to set these two settings.

If you wish to customize the order lot size, you will need to match the child order with the support order. For example, if you increase the child order from 0.01 lot to 0.1 lot, increase the support order from 0.1 lot to 1 lot.

[Video] Check the parameters here at a minimum!

How to Install CyberGurutore

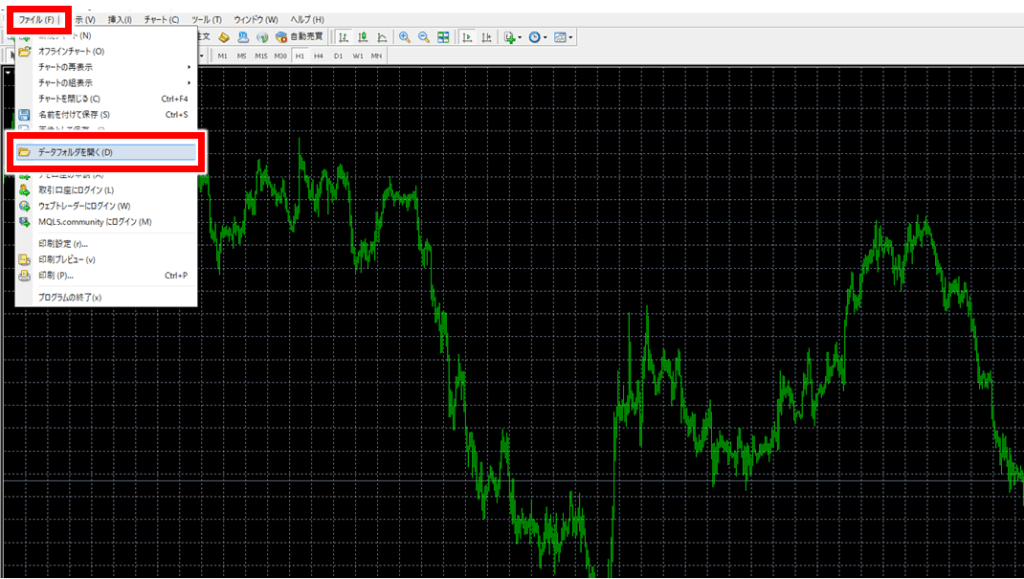

Open MT4 data folder

The method for setting up and running CyberGurutore is the same as for general EAs.

First, select “File” -> “Open Data Folder” in the upper left corner of MT4.

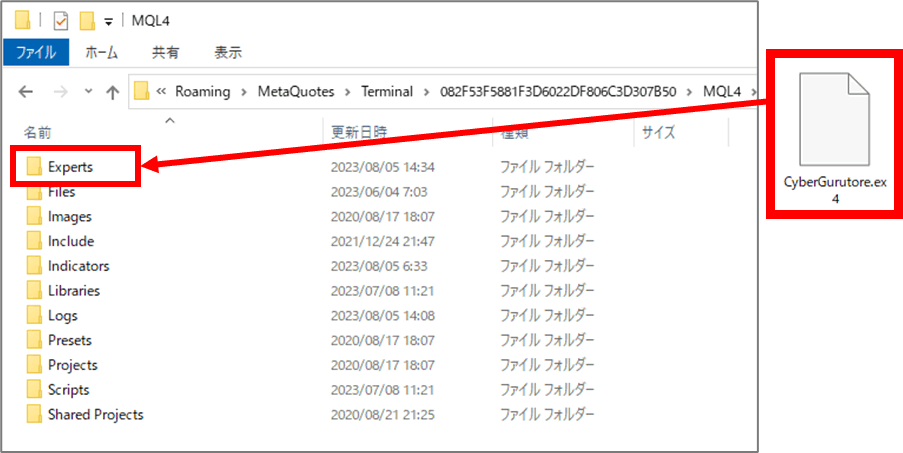

Copy to Expets folder

The data file will open.

Copy “CyberGurutore.ex4” into the “Experts” folder of “MQL4” and restart MT4.

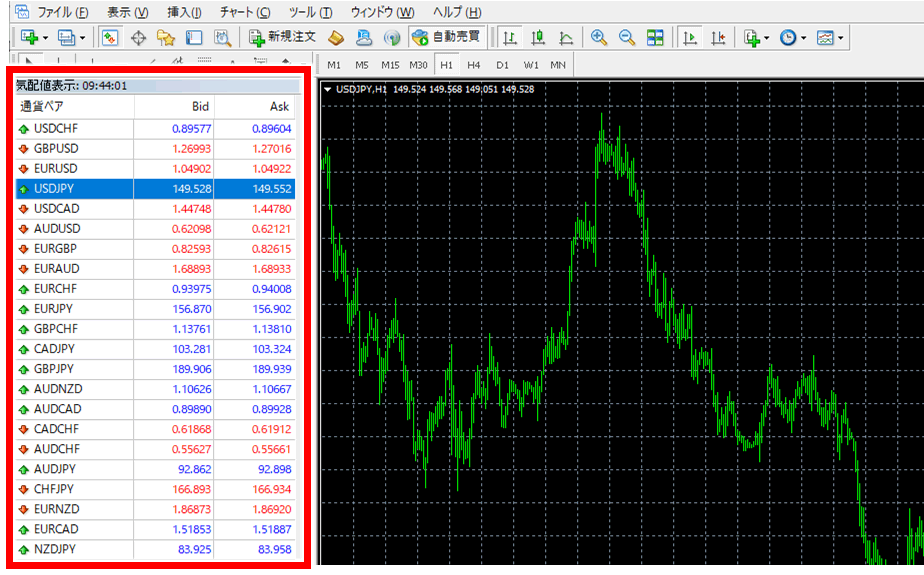

Open the chart you wish to set up

Display any chart you wish to apply.

Double-click on “CyberGurutore”

Drag and drop “CyberGurutore” from the “Expert Advisors” section of the Navigator panel onto the chart.

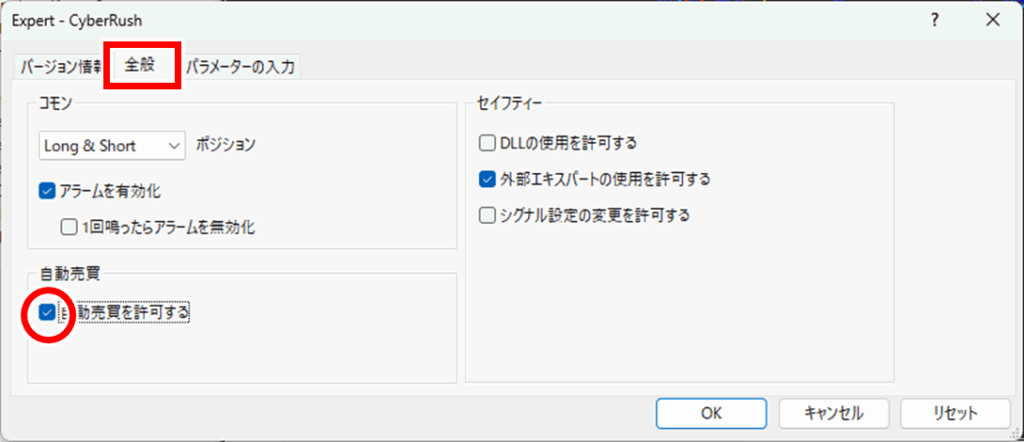

Check “Allow automated trading”

The “CyberGurutore” settings dialog box will appear. Click on the “General” tab and check “Allow automated trading.

*Check it carefully, because the EA often does not work due to a lack of check here.

How to Operate CyberGurutore

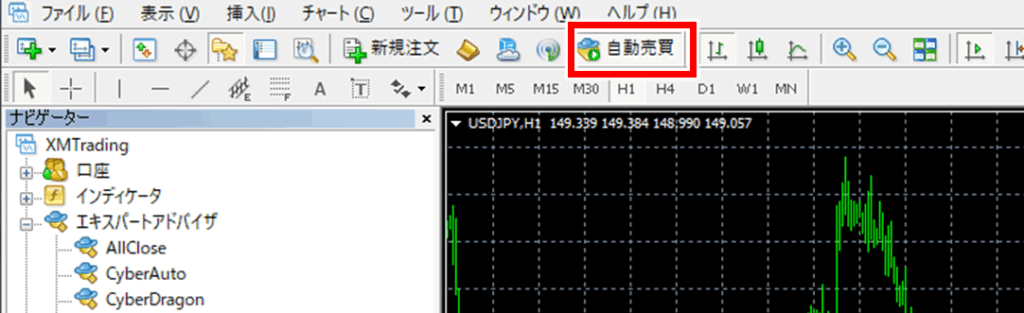

Click on “Automated Trading” at the top of the screen

After completing the settings, click on “Automatic Trading” at the top of the screen.

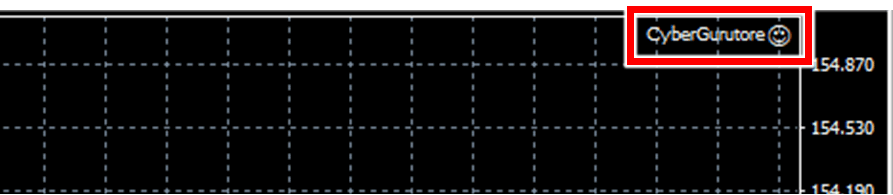

The “☺” symbol appears in the upper right corner of the chart.

When the “☺” mark appears in the upper right corner of the chart, the setting is complete.

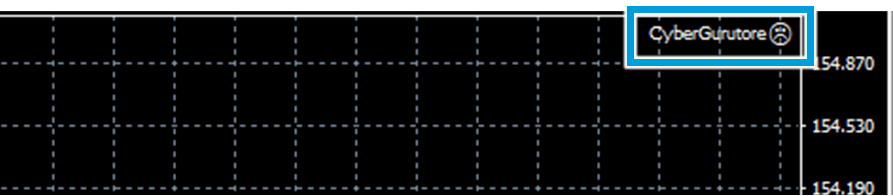

If a different mark is displayed

At this time, if the display is different from the “☺” mark as shown above, please check the manual procedure again.

Orders are placed one after another.

Once the smiley face mark appears, the trade is automatically executed, so there is no need to do anything in particular. Thus, the trade is automatically executed, the mark is displayed on the chart, and the trade status is displayed in the trade window.

How it works in a demo account

The EAs that will be sent to you are compatible with demo accounts, and if you put them in the Experts folder of any demo account, they will work as usual.

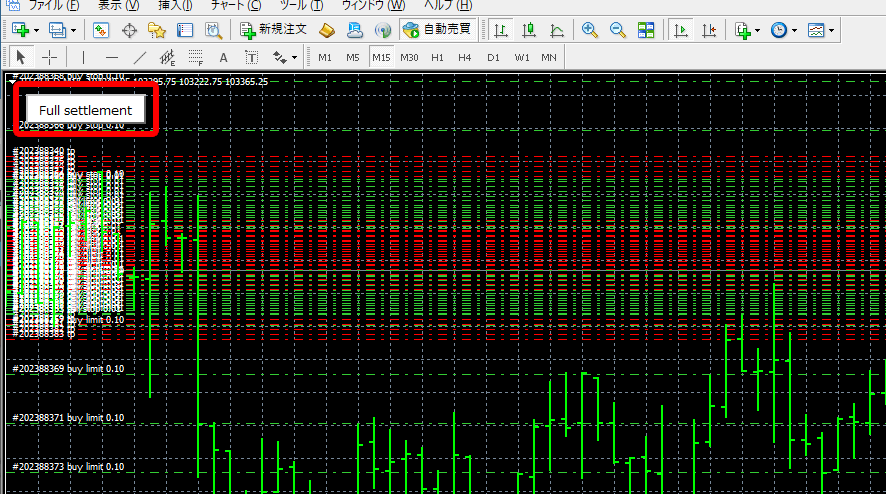

Easy closing with “All Settlement” buttons

Can be terminated by all settlement buttons and parameters.

When exiting CyberGurutore, it is convenient to use the “All Settlement” button displayed in the upper left corner of the chart.

By pressing the “All Settlement” button, the currently placed orders will be canceled, the positions held will be closed, and automatic trading will be stopped.

EA is removed from the chart

(1)Press the “All Settlement” button.

(2)The text of “All Settlement” changes to “Settling” → The color of the button changes (yellow)

(3)All settlement is processed (orders are deleted and positions are closed)

(4)EA is removed from the chart

[Video] How to introduce and set up CyberGurutore

Click here to download CyberGurutore

✔ Predict whether to buy or sell

✔ Profit in the expected direction or range

✔ Profit even if the forecast is wrong, as long as it returns to a certain level

✔ Detailed settings for order interval, profit/loss, etc

✔ Automated trading from a few hundred dollars

✔ Easy to exit by clicking the “Close All” button.

✔ Available for FX, commodities and cryptocurrencies

✔ Can be tested with a demo account

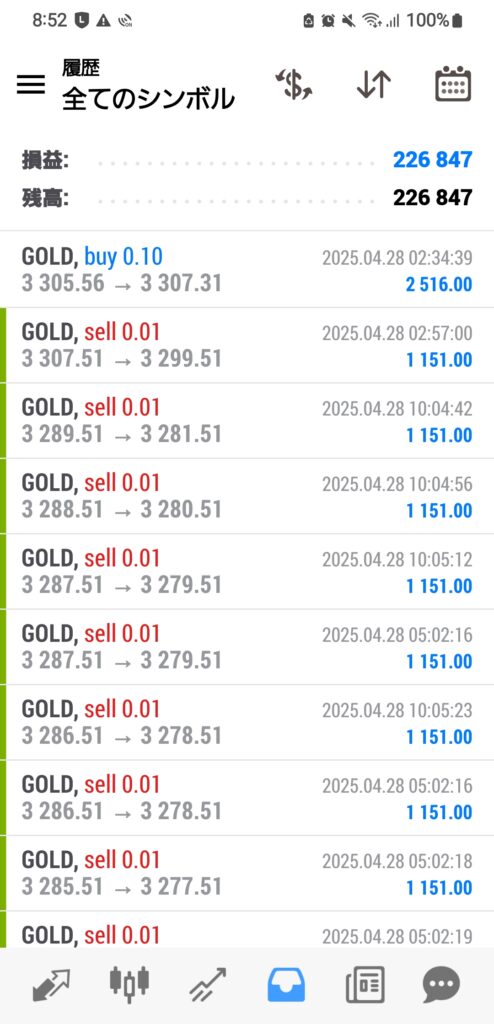

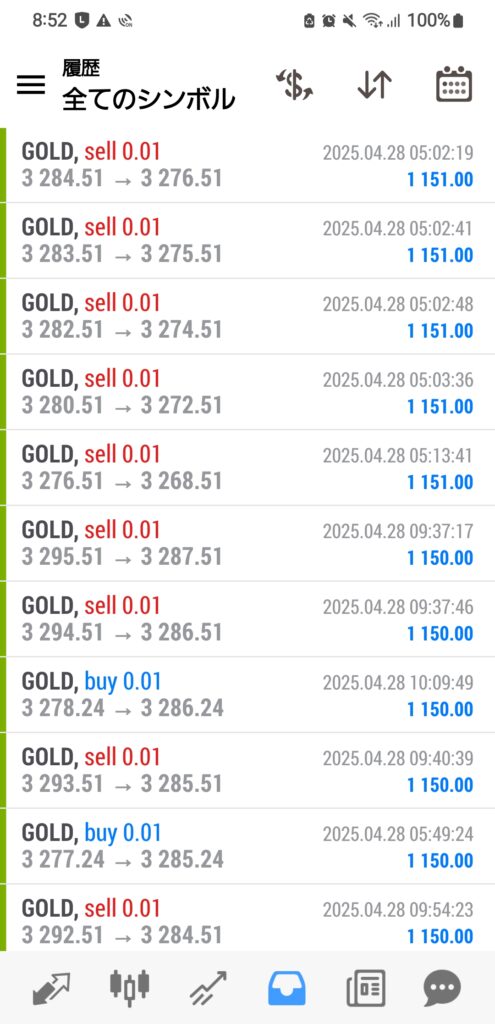

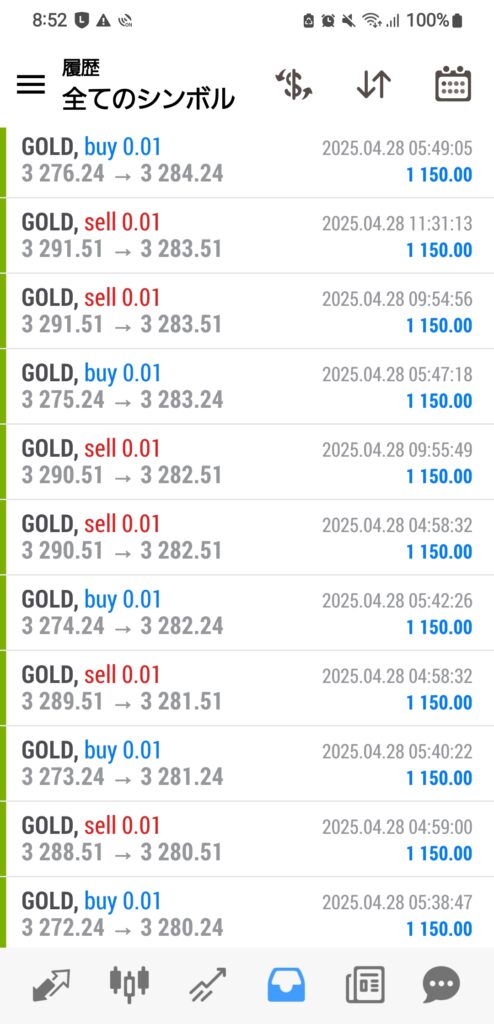

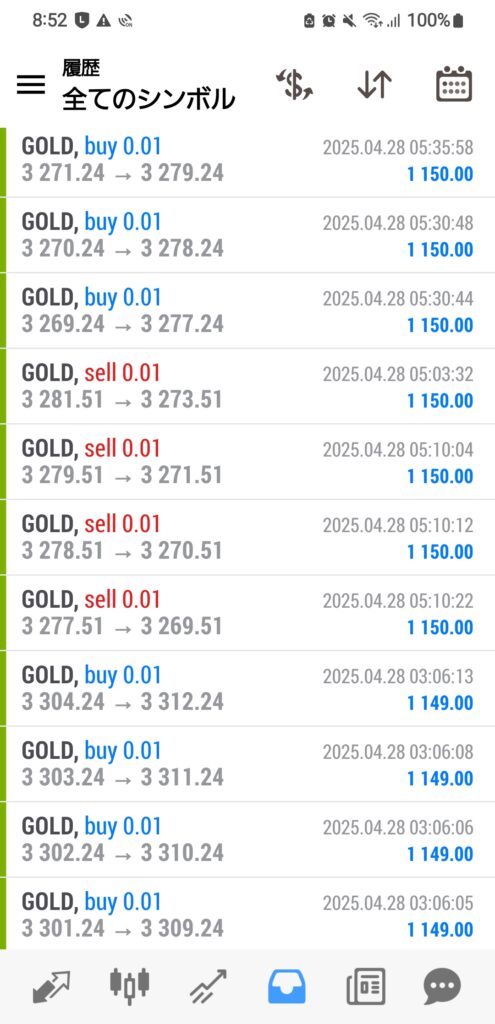

Trade in USD/JPY, +79,790 profit in 5 hours

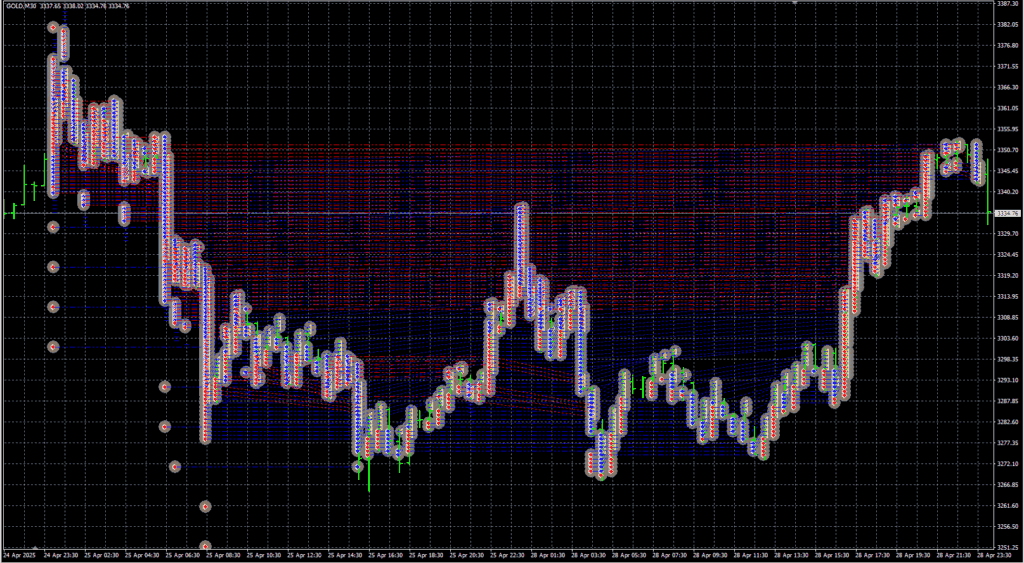

Gold trade, +100,000 profit in 8 hours

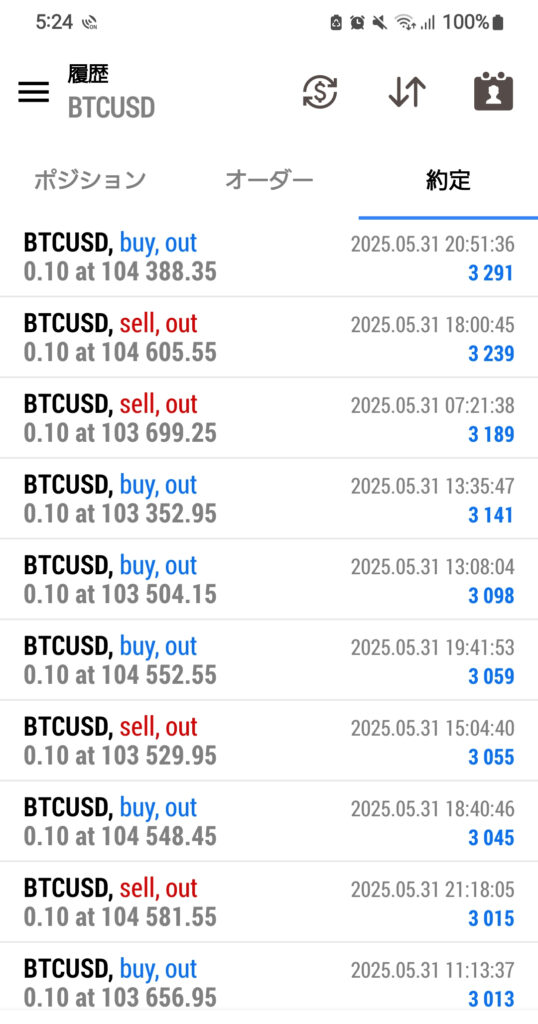

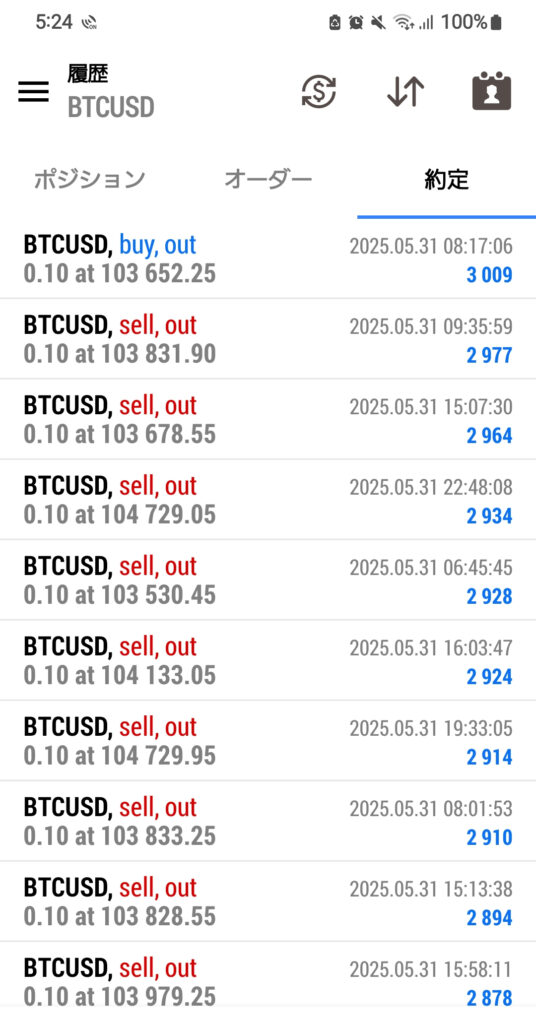

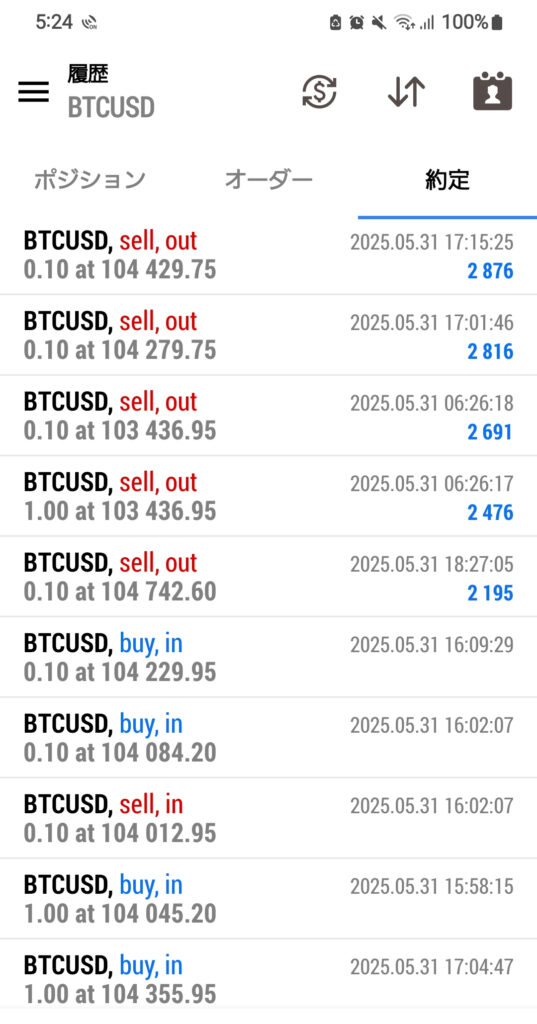

You can gluttle with bitcoin on Saturdays and Sundays

Gurutore EA “CyberGurutore” Review and Reputation

Review of Reviews and Reputation

ぜひ最初のご感想をお聞かせください。